Loading...

How Does Graduate Entry Medicine Funding Work?

One of the most common questions students who are interested in studying medicine as a graduate have is how the funding works. It is slightly more complicated than standard undergraduate degrees, including standard medicine. However, the most important point is that there is graduate entry medicine funding available!

A common misconception is that if you have a previous degree, you will be expected to self-fund the entire medical course. This is a myth and there is funding available for graduates studying both accelerated and standard medicine programmes.

Note that all the figures here apply to students who ordinarily live in England and assume the student is not living at home. If you’re studying in London the figures quoted here may be slightly lower than the actual amounts you’ll be entitled too.

Four-year accelerated GEM programmes

Graduates studying a dedicated four-year graduate entry medical degree are entitled to more funding than a graduate studying a standard degree. It’s worth noting that these programmes are typically more competitive, and if you have the means to fund a five-year course it might be a good idea to apply to a mix of programmes to maximise your chances of getting an offer.

Year 1 Tuition Fee

Your tuition fee will usually be £9,250 per year. You will be responsible for paying £3,465 of this to the University directly. Some universities will let you pay this termly or in instalments but others may expect it upfront.

If you are eligible for a tuition fee loan from Student Finance England, you will be entitled to a non-means tested loan for the remainder of the tuition fee.

Years 2-4 Tuition Fee

For the remaining years, the NHS Bursary scheme will pay the first £3,715 towards your tuition fee. The remaining £5,535 will be covered by a tuition fee loan from Student Finance England. This means that over the entire 4 years you will only need to pay £3,465 directly to the university.

Boost your Chances with our GEM Tutors!

Year 1 Living Costs

For the first year, if you are eligible for Student Finance you may be eligible to take out a loan towards your maintenance costs. The first £4,422 of this loan is non-means tested and the remainder is dependent on household income. You may also be eligible for means-tested support from your university for this year.

It’s important to consider that the Student Loans Company consider any student who is over the age of 25, married or in full-time employment for three years to be an independent student. This means that your parents household income will not be assessed for means testing and you’ll likely be awarded the full maintenance loan if your personal income is £0 for the academic year.

Years 2-4 Living Costs

Over years 2-4 the maintenance loan provided by Student Finance England is reduced to £2,534. This is non-means tested and slightly reduced for your final year.

You are also eligible for maintenance support from the NHS Bursary scheme. The first £1,000 of this is non-means tested. Additional money is means-tested, with the maximum possible grant for a 30-week year being £2,643. The majority of medical schools operate a longer academic year than this and an additional £84 per week is provided for any week over 30.

You may also be entitled to other money such as Childcare Allowance or Dependents Allowance.

Students from other UK nations:

Welsh Students

Funding for GEM is virtually identical to that of English students, apart from your living allowance from the Welsh equivalent of NHS Bursary is identical to that of a fifth year standard medical student. This means you can apply for an additional maintenance loan for Years 2-4.

Scottish Students

If you study on the ScotGEM programme your tuition fees will be fully funded! Unfortunately for all other GEM programmes you will have to self-fund the tuition fee for the entire course. However you will be eligible for a student loan to help with maintenance costs.

Norther Irish Students

Unfortunately students from Northern Ireland will have to pay the full tuition fees themselves. Students are eligible for a maintenance loan from Student Finance NI to help with living costs.

Five/six-year standard medicine programmes

Years 1-4 Tuition Fee

Your tuition fee will usually be £9,250 per year. You will be responsible for paying the full amount to the university directly. Some universities will let you pay this termly or in instalments but others may expect it upfront.

Years 5+ Tuition Fee

From Year 5 onwards you will be able to apply to the NHS Bursary Scheme for tuition fee support. Your tuition fee will be payed in full and you will not have to pay this money back.

Years 1-4 Living Costs

For the first four years you will eligible to apply to Student Finance England for a full maintenance loan. The amount you receive will depend on your circumstances and where you’re studying.

As with GEM courses, it’s important to consider the Student Loans Company criteria for being classified as an independent student. If this applies to you it means that your parents household income will not be assessed for means testing.

Years 5+ Living Costs

The final years of your course will be funded by the NHS Bursary Scheme. They will provide a non-means tested grant of £1000 for living costs. Additional money is available and is means-tested based on your personal circumstances. The maximum bursary available is £3,191 based on a 30-week year. There will be an extra weeks allowance of £108 per week for any additional weeks spent studying.

Students from other UK nations:

Welsh Students

Funding is very similar to that of English students. One key difference for Welsh students is the living allowance is identical to that of a fifth year standard medical student for the final part of your course. This means you can apply for an additional maintenance loan for Years 5+.

Scottish Students

You will have to self-fund tuition fees for the first four years. In England and Wales this is typically £9000-9250. If you study in Scotland, you will pay £1,820 per year instead. You’ll also be eligible to apply to SAAS for a maintenance loan. For Years 5+ you are eligible for full tuition fee support and a bursary to cover living costs from SAAS.

Norther Irish Students

Unfortunately students from Northern Ireland will have to self-fund the full tuition fees throughout the course. Students are still eligible for a maintenance loan from Student Finance NI to help with living costs.

Frequently Asked Question

→What is graduate entry medicine funding?

Graduate entry medicine funding is financial support provided to students who are pursuing a medical degree at the graduate level. This funding is designed to help students cover the cost of tuition fees, living expenses, and other associated costs.

→What types of graduate entry medicine funding are available?

There are several types of graduate entry medicine funding available, including scholarships, grants, loans, and bursaries. Scholarships and grants are typically awarded based on academic achievement, while loans and bursaries are usually awarded based on financial need.

→How do I apply for graduate entry medicine funding?

The application process for graduate entry medicine funding varies depending on the funding source. Some funding sources require students to submit an application form, academic transcripts, letters of recommendation, and a personal statement. Other funding sources may require additional documentation, such as a financial aid application or a statement of need. Students should carefully review the application requirements for each funding opportunity and submit their application before the deadline.

→Can I receive multiple sources of graduate entry medicine funding?

Yes, it is possible to receive multiple sources of graduate entry medicine funding. However, students should carefully review the terms and conditions of each funding source to ensure that they are not violating any rules or regulations. Additionally, students should notify each funding source of any additional funding they receive to avoid any potential conflicts or issues.

→What UCAT score do you need for graduate entry medicine?

The UCAT (University Clinical Aptitude Test) score requirements for graduate entry medicine in the UK can vary depending on the university and the program.

Some universities do not require the UCAT for admission to graduate entry medicine programs, while others do require it as part of the application process. For those universities that do require the UCAT, the minimum score required may differ.

In general, the UCAT score requirements for graduate entry medicine programs tend to be higher than those for undergraduate medicine programs. This is because graduate entry medicine programs are typically shorter and more intensive, with a greater emphasis on clinical experience and advanced medical knowledge.

Students who are interested in applying for graduate entry medicine should check the admission requirements for each university and program they are interested in to determine if the UCAT is required and what the minimum score requirements are. It is also important to note that the UCAT score is only one part of the admission criteria and universities will also consider other factors such as academic performance, work experience, and personal statement.

→How do people afford Graduate Medicine UK?

There are several ways that people can afford graduate entry medicine in the UK:

- Scholarships and grants: Many universities and private organizations offer scholarships and grants to students pursuing graduate entry medicine. These funds can cover some or all of the cost of tuition fees and living expenses.

- Student loans: Students can apply for government-backed student loans to cover the cost of tuition fees and living expenses. These loans have low interest rates and do not need to be repaid until the student graduates and begins earning a certain amount of income.

- Part-time work: Some students choose to work part-time while studying to help cover their living expenses. This can include jobs on or off campus, such as working in a retail store or restaurant.

- Personal savings: Some students may have personal savings that they can use to pay for tuition fees and living expenses while studying.

- Family support: Some students may receive financial support from their family members to help cover the cost of tuition fees and living expenses.

- Combination of sources: Many students use a combination of the above sources to afford graduate entry medicine in the UK. For example, they may receive a scholarship or grant, take out a student loan, and work part-time while studying.

It is important for students to carefully consider their financial options and develop a plan to cover the cost of their education. They should also research and apply for all available funding opportunities to increase their chances of receiving financial assistance.

Related:

Related:

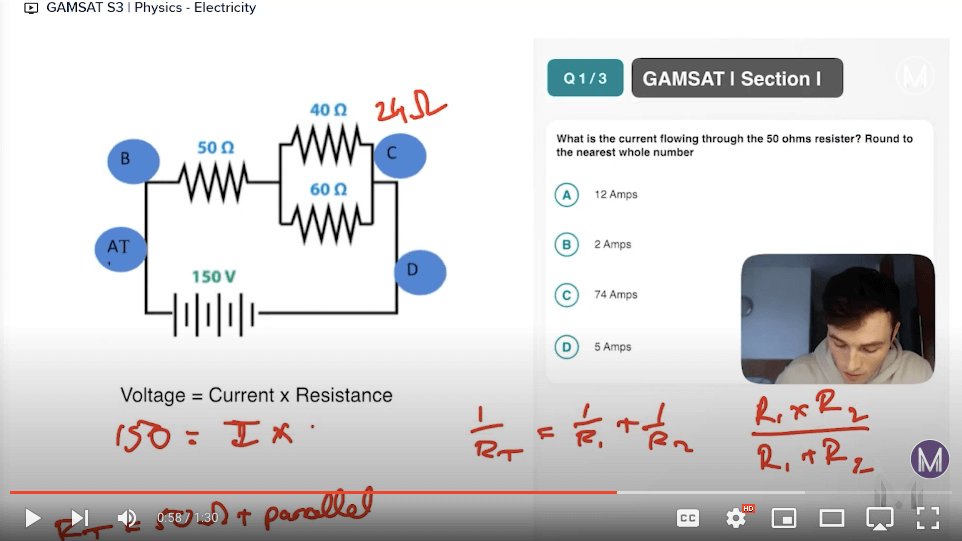

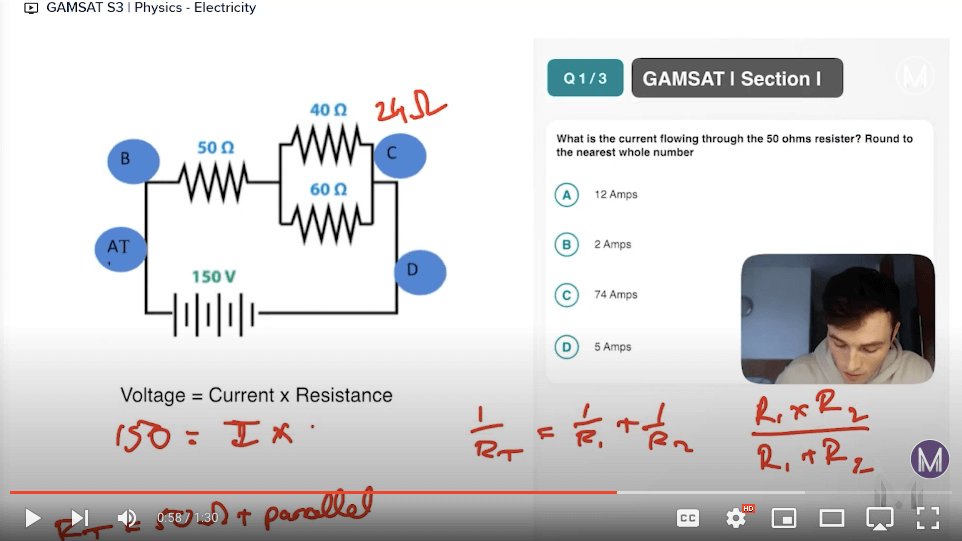

Personalised 1-1 private lessons, tailored to your GAMSAT needs

With over 1000 GAMSAT questions, worked examples and mock run-throughs - your complete GAMSAT course!

Prepare for the GAMSAT with a full day of expert GAMSAT tuition, learning the tips and tricks to boost your score to the maximum.

Was this article helpful?

Still got a question? Leave a comment

Leave a comment

366 Comments

LeonMedic Mind Tutor

30 July 2021

It isn’t at all clear what paying a proportion of the tuition fee directly to the University in question means. If this is merely a cosmetic point, why add it?

Anna CharlotteMedic Mind Tutor

2 August 2021

Hi Leon, I’m not sure exactly what you mean by “cosmetic point”. The majority of home students studying in the UK will pay their tuition fees through the relevant student finance company, meaning they won’t perform the transaction themselves as the loan company will pay the loan to the university. The exceptions are described here where graduates may have to pay all of, or a portion, of their fees directly – meaning they will not receive a loan and the money will need to be paid directly by them (from their bank accounts) to the university. This situation is not the norm in the UK hence the emphasis of this in the article. Hope that helped to clarify things for you.

JamesMedic Mind Tutor

23 September 2021

Just to clarify: the SFE loan for years 2-4 (GEM) is available to those who have already completed a full undergraduate qualification?

So one would be liable for £3465 in year 1 only?

Many thanks.

Anna CharlotteMedic Mind Tutor

24 September 2021

For English students studying in England, that’s correct. Your maintenance loan will be non-means tested for Years 2-4 though so this could potentially drop. However you won’t need to directly pay the university any portion of your tuition fees apart from in Year 1.

OliverMedic Mind Tutor

19 January 2022

Hi, it says that in terms of maintenance loans (living costs NOT tuition) the first 4 years are funded by SFE and only years 5 plus is funded using the NHS bursary and grant. It was my understanding from other online sources including the UoN website and SFE that it is actually full SFE maintenance loan for year 1 and NHS bursary etc for years 2-4. Is this a mistake?

Anna CharlotteMedic Mind Tutor

6 February 2022

Hi Oliver, it depends if you study a four-year accelerated or a standard five/six year programme. For the four-year long GEM courses you’re right (and this is what the UoN website is referring to I believe), but a graduate on a standard five or six year course will only be funded by NHS bursary in their final year. Hope that makes sense.

AnonymousMedic Mind Tutor

3 July 2022

If I do a masters, MSc/PGDip/PGCert, can I still apply for funding to study graduate entry medicine?

Anna CharlotteMedic Mind Tutor

23 July 2022

Yes, you’ll still be funded for four-year graduate entry courses if you have a postgraduate qualification.

sk atikur rahmanMedic Mind Tutor

20 July 2022

I am an international student. I recently graduated with a BSc in aircraft maintenance with a 2:1 result( University of South Wales, UK). What will be the requirement and tuition fees for me? thanks

Anna CharlotteMedic Mind Tutor

23 July 2022

International students can apply for graduate entry medicine at Warwick, Chester, Worcester, QMUL, KCL, Newcastle, Nottingham, Oxford or Swansea. You need to check individual websites for international tuition fees but it is usually around £30-40,000 per year.